Is real estate in Switzerland a good investment?

The limmat was chilly 14.4°C when this was posted. 8 min readBuying real estate in a big city like Zurich is estimated to be 35% more expensive than renting. A rough rule is that every 500k in purchase price results in about 1k rent, so a 2M apartment should rent for 4k per month. This is a palsy return-on-investment (ROI) of just 2.4% per year and that’s ignoring income tax, mortgage interest, maintenance costs, etc, which makes this an even poorer deal. For big, desirable cities like Zurich, the rental yield tends to be even worse, specially due to the lack of inventory (a popular swiss real estate website shows 243 properties for sale on June 8th vs 1039 for rent).

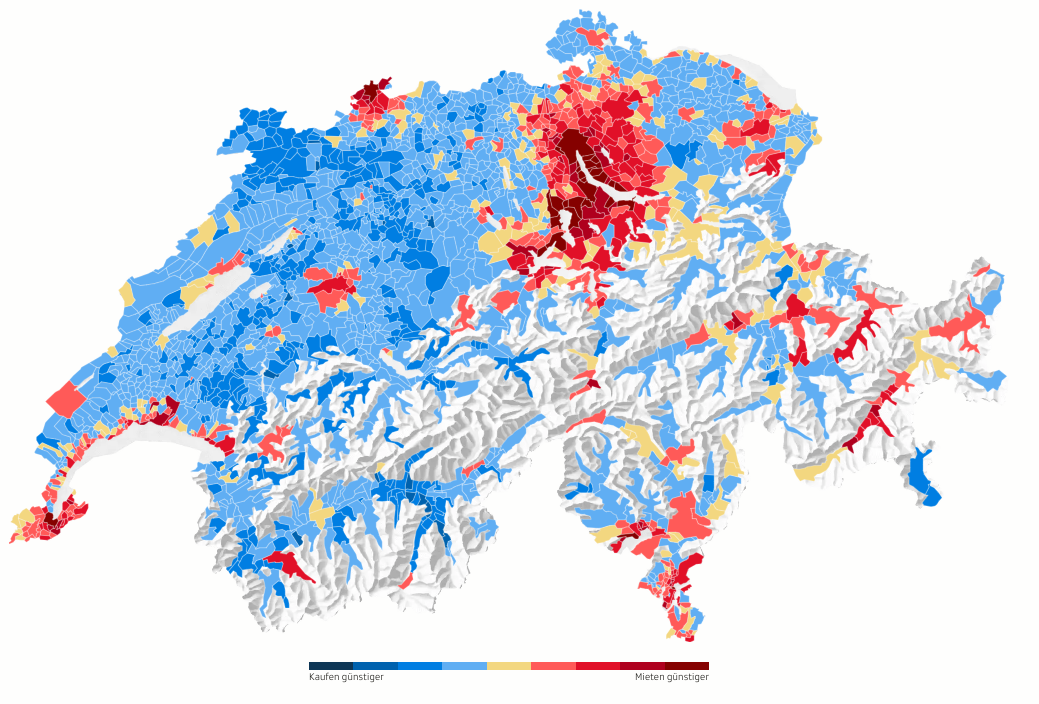

Where in Switzerland is it cheaper to buy than to rent? Blue indicates cheaper to buy than to rent. Red means the opposite. Source: SRF.

Don’t let yourself be fooled by the chart above. By area it may look like it tends to be cheaper to buy than to rent, however those are mostly rural areas. The urban centers where most people live such as Geneva, Basel, Bern, Zug, Luzern and Zurich are very red. These areas tend to have a terrible rental yield.

So why does anyone even buy real estate?

2.4% per year doesn’t sound that interesting. Just buy stocks, right? After all, the historical inflation-adjusted average return of the largest 500 companies in the US (S&P500) is 7.26% when dividends are reinvested (not fully accurate though: dividends are taxed as income in Switzerland).

Here’s what I learned though: you should not decide to invest in property just by looking at rental yields. There are mostly two other things that make investing in real estate interesting:

- Appreciation. Properties tend to be an investment that is considered safe and that have been increasing in value.

- Mortgages. Mortgage interest payments are tax free in Switzerland, which is specially good if you’re paying high income taxes (you probably have high income if you can afford buying anyways). Additionally mortgages are a form of leveraging your investment, which we will soon learn is a great way to boost your yield.

Of course, the other (somewhat irrational) reason is that people just want to own where they live. This is however not a financially sound argument, so let’s focus on the reasons above.

1. Appreciation

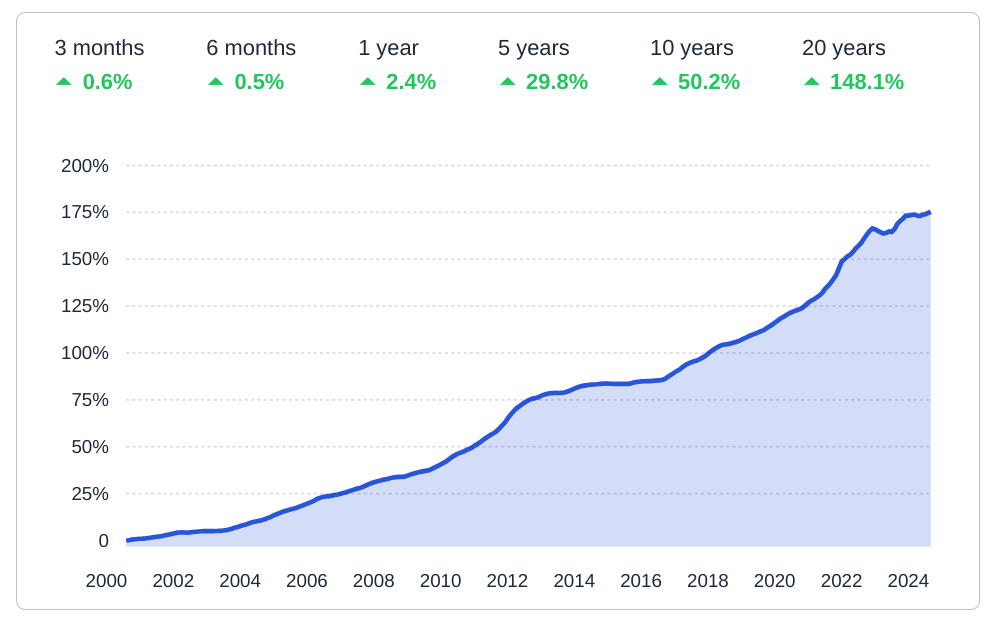

Real estate in Switzerland has historically shown a steady appreciation in value. Property prices only go brrrr in Switzerland, as clearly shown by the graph below for the city of Zurich.

Historical property purchase prices for the city of Zurich. Source: Realadvisor. I’ve also validated this with the data from the official cantonal website; it’s correct

Note that a 148% return in 20 years translates to a ~4.5% ROI per year, which significantly boosts the previous rental yield that we estimated to be 2.4%. If we look at all of Switzerland instead of just Zurich, the 20 year median appreciation is not quite so extreme, but still a very respectable 84.5% (~3.1% ROI/y).

Why does real estate keep growing in value?

In my opinion there are 3 main reasons why real estate tends to gain value:

- Limited land availability [1]. Switzerland is a tiny country, with most urban areas already fully developed. This means there’s barely any land left for building something new. In urban areas most new inventory comes from adding an additional floor or two to existing buildings (or demolishing and building something new).

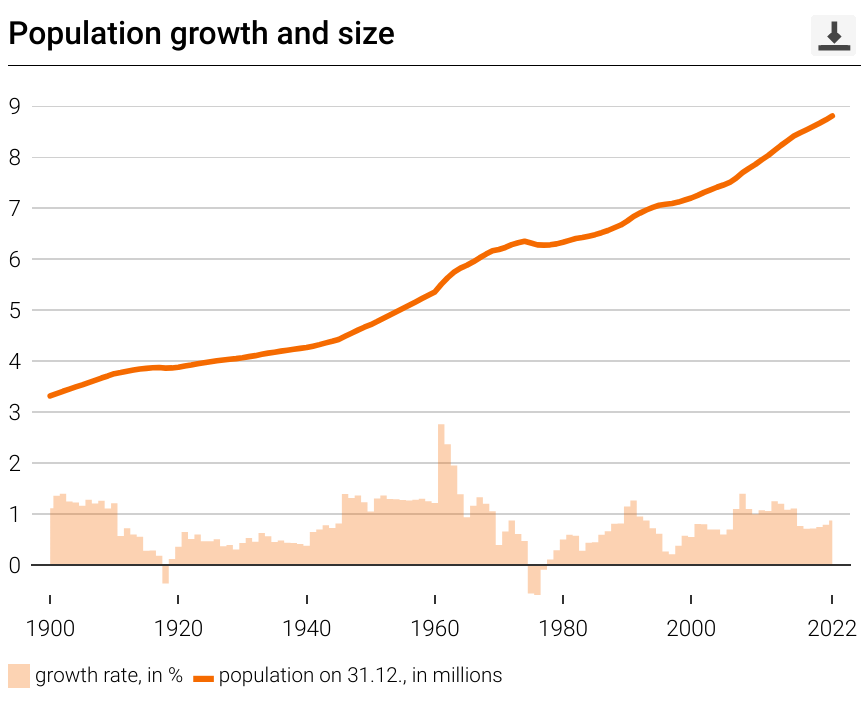

- Steady population growth [2], in the last decades mostly due to strong immigration trends. This creates a natural demand for housing.

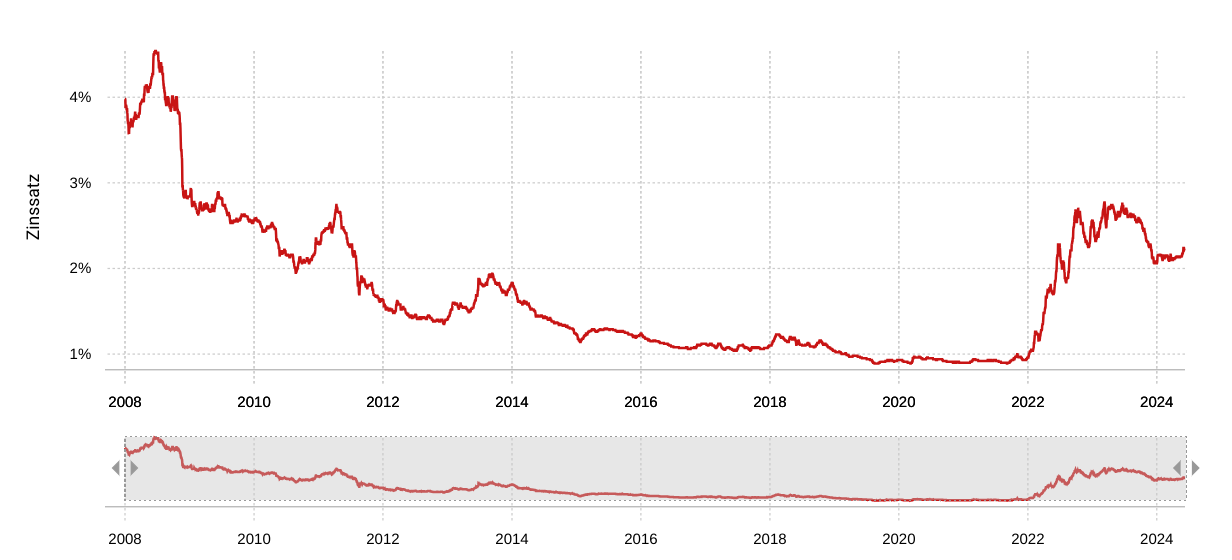

- Stable, low interest rates [3]. Switzerland boasts a strong, robust economy. Combine low interest mortgage payments with tax deductions and you get people quite interested in buying.

Historical 5-year mortgage interest rates in Switzerland. Source: Comparis.

This basically sums up to restricted availability and strong demand: a virtuous cycle of growth in home values. I don’t think any of the three is changing any time soon. If anything interest rates will start to go down soon, which will push demand even higher.

2. Mortgages

Mortgages are a powerful way of magnifying your return-on-investment. In essence they are nothing more than borrowing money, so they work as multiplier of either gain or loss.

Let’s assume you have a property worth 1 million swiss francs, renting for 40k CHF, i.e. 4% per year. In Switzerland you can borrow up to 80% of the property value as a mortgage, which means you only need to invest 200k of your own money. You are now 5x leveraged, which means your yield, calculated as a percentage of your initial investment, will also be multiplied by 5x. Indeed, as 40k divided by your initial investment of 200k is 20%. You still need to subtract your mortgage interest to calculate your real yield: mortgage interests are currently ~2%, meaning a cost of 16k per year, you’d still have 24k/200k => 12% yield instead of the initial 4%.

Now, mortgage interest can be deducted from your taxes in Switzerland, so if your marginal income tax (how much tax you pay for every additional swiss franc earned) is 40%, you’re only paying 60% of the 2% interest rate. This means your mortgage cost is 9.6k instead of 16k, meaning also that your yield is now (40k-9.6k)/200k => 15.2%.

Sounds pretty good. But what are the risks in taking a loan?

With low interest rates it’s probably a good idea to never fully pay your mortgage: as we’ve seen above, due to the nature of loans and tax advantages, this is a cheap way to increase your yield. However, there are several risks in having high leverage:

- Interest rate goes up: if you have a fixed-rate mortgage the risk here is much smaller, however, fixed-rate mortgages tend to have an expiration date, by which you will have to either pay your property or renew your mortgage. Note that the math above changes significantly if the mortgage interest rate is 4%: 4% * 800k * (100%-40%) = 19.2k costs instead of 9.6k. In a worse case scenario, if you can’t fill the affordability criteria for a mortgage under increased interest rates you may be forced to sell your property to cover the costs.

- Empty property: no rental income to pay for your mortgage. This also has a significant affect on the math above.

Opportunity cost: stocks

An alternative to investing in real estate, as mentioned previously, are stocks. Stocks have several advantages over owning property:

- Extremely liquid, buy and sell with literally a click of a button;

- Zero maintenance costs (assuming you have a good broker), zero headaches (no finding new tenants, no property management);

- Picking what to buy is much easier, with troves of information and recommendations to buying passive funds that track known indexes, such as the S&P 500. Unfortunately there’s no equivalent for real estate;

- 0% capital gain tax on stocks vs significant capital gain tax on real estate (progressive, from 10 to 40% for Canton Zurich);

- Historical returns have been very generous: 50-year ROI/y of S&P 500 is 7.26% 🤑

Another alternative are swiss real estate funds, such as the Credit Suisse Real Estate Green Property which due to its direct ownership structure incurs no wealth tax and no income tax on the dividends. However, the price of this fund do not seem to really reflect the actual price of houses, which as we have seen before, only goes up:

Performance of the Credit Suisse Real Estate Green Property Fund. Compare this to the Zurich property price chart. Source: finanzen.ch

There are some advantages to owning real estate compared to stocks too:

- No currency risk. ETFs tracking indexes like S&P 500 are typically exposed to exchange-rate risk, as the main currency is USD yet your life costs are in swiss francs. While this can be mitigated with hedging, this also comes with costs.

- Arguably owning swiss property is seen as a safer investment than stocks. It definitely doesn’t have the swings seen in stock markets.

- (If you lease your property) Constant, passive stream of income. Rent is an (almost) safe source of passive income, which is perfect if you’re looking to retire early.

- (If you live in your property) Nobody can kick you out, do what you want! It’s your place.

- Portfolio diversification. Owning real estate has low correlation with stocks (just compare the S&P 500 and the Zurich property prices chart), which means reduced risk and volatility in your investment portfolio. While one class of assets may be declining, since they have low correlation, the other classes may be unaffected or performing well. The choice here shouldn’t be stocks or real estate, but rather and.

Ok, so should I buy?

Personally, I think owning a property can be a good investment, even if perhaps it has lower returns than stocks. This is a great asset class for diversification, is rather safe and if you dream of ever living in a place you own, can be a great stepping stone in that direction. Not necessarily you have to buy a property to live in it, the math also works or may be even more favorable of buying a place to rent. This decision however highly property-specific and depends on where you want to live / let.

In a future post we will simulate how much it actually costs to buy a property, how much you’d save if you live in it or how much is left in rent if you decide to let it. We will go over notary fees, income tax, maintenance costs, mortgage amortization, building insurance, capital gain tax and so on. It will show you how each component factors into the cost and will teach how to compute your final (estimated) profit.